IRS Form 1098-T

What is Form 1098-T?

The University of Dayton issues Form 1098-T annually to any student who paid qualified educational expenses in the previous tax year. Qualified expenses include tuition, required fees and course materials.

Purpose of the 1098-T

The IRS Form 1098-T is not like the IRS Form W-2 obtained from your employer. The primary purpose of the IRS Form 1098-T is to let you know that UD has provided required information to the IRS to assist them in determining who may be eligible to claim the tuition and fee deduction or an education credit on IRS Form 8863 - Education Credits.

Receiving Form 1098-T does not necessarily indicate that you are entitled to claim any of the education-related tax credits or deductions. There is no IRS or UD requirement that you must claim a tuition and fees deduction or an education credit.

Claiming education tax benefits is a voluntary decision for those who may qualify.

You should not rely solely on the information in this tax statement. If you are taking the tuition and fee deduction or claiming one of the education credits, you should also use your own records to determine tuition paid, refunds of qualified expenses, and tax-free educational assistance. To assist you with determining the amount of qualified tuition you paid during the year, we recommend referencing prior billing statements or downloading the student's billing statements for each relevant semester via the UD Payment Center.

Please be aware that the 1098-T captures financial information on a calendar year basis (January 1 - December 31).

The University is unable to provide tax advice regarding the use of your 1098-T in preparing your tax return. Parent(s)/student(s) should contact a tax advisor/preparer for help with the use of this form.

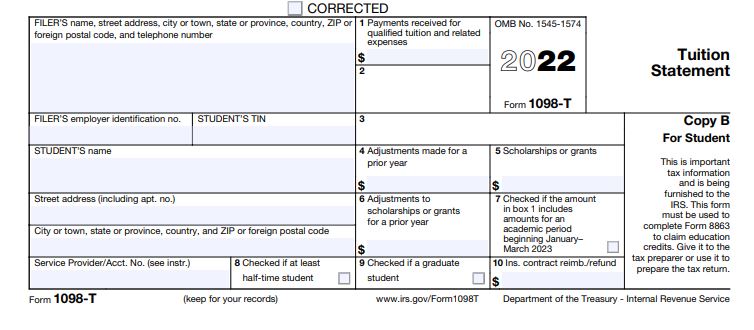

Below is a blank sample of the 2022 Form 1098-T for your general reference.

Accessing the 1098-T

If you are eligible to receive the 1098-T, you can expect it to be mailed by January 31. In My Payment Center, students can make the choice to opt out of the paper 1098-T and receive an electronic copy only. You will receive an email notification and have the ability to view and/or print your form securely online immediately.

Eligible students who did not receive a 1098-T in the mail have opted to receive the information in electronic form only. The electronic 1098-T is also available to those who received a paper copy by mail.

Student Retrieval:

Log into the Payment Center at go.udayton.edu/paymentcenter. Click 'My Account' and select 'Statements' to access the 1098-T form. Please note that you will see a box entitled "Enter Code" before viewing the statement, there is no code to be entered.

Parent Retrieval:

If your student has already set you up as an authorized user and enabled access to view the 1098-T, please use your Payment Center credentials to view the form. Please note that you will see a box entitled "Enter Code" before viewing the statement, there is no code to be entered. Authorized User Login

Parents without authorized user access will need the student to complete the following:

Log into the Payment Center at go.udayton.edu/paymentcenter and click on 'Authorized Users'. Providing the authorized user email address and giving permission to view the 1098-T form will generate an email. Upon receipt, log in credentials can be established allowing access.