School of Business Administration

Real Portfolio/Real Results

The Davis Center for Portfolio Management, an Experiential Learning Center of Excellence at the School of Business Administration, gives students real-world portfolio management experience by managing the Flyer Investments Fund -- the largest student-managed portfolio in the U.S.

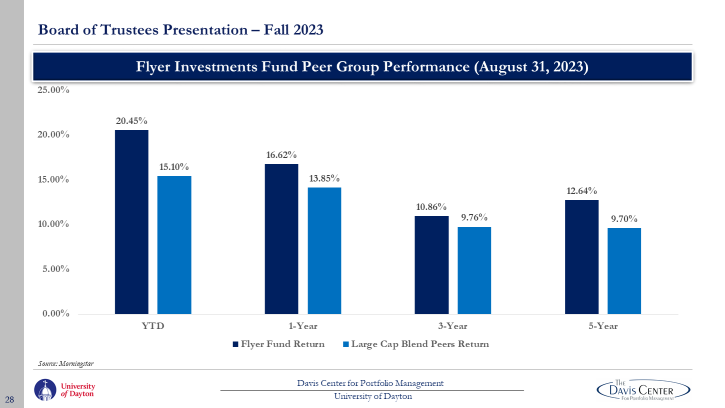

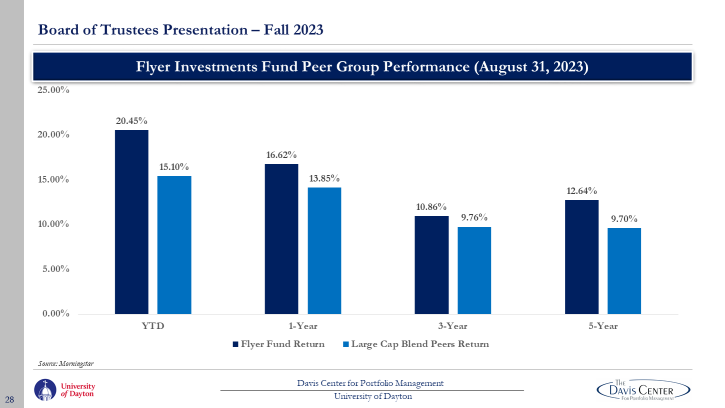

With assets under management of approximately $64.4 million for the University endowment, The Davis Center recently posted strong annualized returns. According to BNY Mellon, an investment company that provides investment services in markets worldwide, the Flyer Investments Fund through Aug 31 gained 20.45% year-to-date, outperforming the benchmark, the S&P 500 index, by approximately 172 basis points.

"As the largest student managed investment fund in the country, the size of our fund is frequently advertised. But it's the process and the performance that I find most impressive. Despite seeing almost 25% turnover in our student leadership team every spring, the Flyer Investment Fund has managed to outperform its benchmark, the S&P 500, in six of the last seven years!" Trevor Collier, Dean of the School of Business Administration, explains.

"It is obviously cool to boast that we are the largest student-managed fund in the country, but we take a lot more pride in the fact that we have consistently outperformed our professional competition," states Senior Manager of the Davis Center, Jimmy Olson '24. "Year to date, our performance sits around the 90th percentile of a peer group that consists of over 1100 professionally managed mutual funds, and we are very proud to say that we have been able to grow the university's endowment faster than an outside manager would have. It's a testament to how strong our investment process is, and it feels especially good to win for the university given the immense trust that it has placed in our student management team." The University of Dayton Flyers have outperformed the Morningstar Large Cap Blend Peer Group in each period, notably year-to-date (+20.45% vs. +15.10%) and 5-year (+12.64% vs. +9.70%).

According to the Director of the Davis Center, Prof. Dan Kapusta, "these strong absolute and relative investment returns are the result of our dedicated team of approximately 60 analysts in the Davis Center -- all undergraduate students." Since 2010, over the years, these student managers, with alums of over 700, have generated approximately $50 million in capital gains for the university!

This bar chart represents the Fund's investment performance relative to the Morningstar peer group of approximately 1,100 mutual funds. Our University of Dayton Flyers have out-performed in each period, notably year-to-date (+20.45% vs. 15.10%) and 5-year (+12.64% vs. +9.70%).