Hanley Center for ESG Investing

Hanley Sustainability Fund Teams

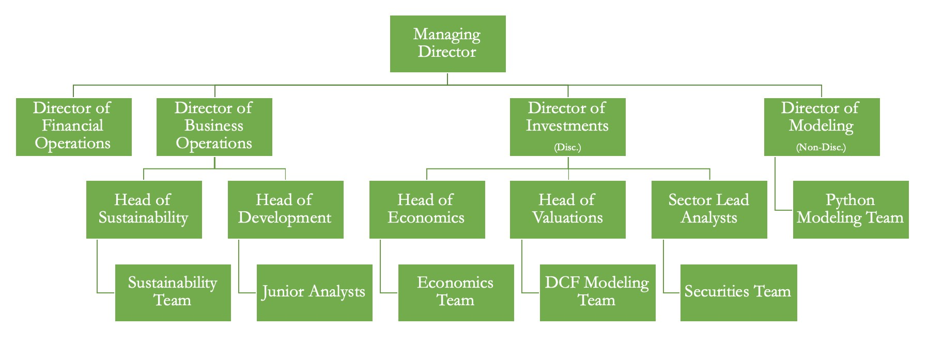

Management Team

- The management team is responsible for maintaining the overall health and culture of the Hanley Trading Center and the Hanley Sustainability Fund. Every year, new managers are selected from within HSF by election from prior managers and the fund’s current full-time members.

Securities Analysis Team

- Members of the securities analysis team are responsible for acting upon a variety of strategies for financial analysis, including qualitative research and financial modeling. Lead Analysts will send out end-of-month updates regarding performance and updates to any strategies moving forward for their sector. All analysts produce earnings updates every quarter reflecting a bullish or bearish outlook on the sector and our current investments in correspondence to the original investment thesis. Analysts with their sector team are required to pitch at least once a semester and vote on weekly pitches.

Economic Analysis Team

- Members of the economic analysis team focus on providing a top-down view of the markets for the securities analysis team. Economic analysis team members monitor economic indicators and relevant current events to assist in creating an economic outlook for every sector as well as specific industry viewpoints for weekly equity pitches.

Valuation Team

- The members of the valuation analysis team build Discounted Cash Flow (DCF) models for each of the Fund’s pitches to project the perspective company’s financial performance in bull, bear, and base cases that support the investment theses. The Head of Valuation leads a Valuation Education Program, consisting of four parts. The education program covers basic financial metrics used in valuation, building out a DCF, forming a Comparable Company Analysis model, and discuss Leveraged Buyout (LBO) models. Upon completion of the program, members will be able to effectively communicate the result of their model when presenting a stock pitch and add the highly sought-after skill of valuation to their financial experiences.

Sustainability Reporting Team

- The sustainability reporting team is responsible for all sustainability analytics for the fund as they determine the ways in which to evaluate and rank corporate social responsibility. Under Hanley's sustainability values, team members incorporate their metric valuations with the mindset of climate action, agriculture insecurity, water preservation, and renewable energy solutions. In addition, this team works directly with the Hanley Sustainability Institute, which makes these members uniquely qualified to discuss and score the sustainability of large corporations.

Model Development Team

- Members of the model development teamwork on improving upon the existing quantitative model through actual development of the code behind the model or analysis of collected data on the model. Due to the technical nature of the model, members of this teamwork on the Python backtest that drive the model and contribute through data collection and analysis for new ideas or avenues to explore in the model’s development.

Business Operations Outreach Team

- The business operations outreach team focuses on the resources of the Hanley Trading Center to the greater University of Dayton community. In addition, this group oversees the fund’s image by organizing and executing the outreach and volunteer work that is done as a full fund every year.

Junior Analysts

- The Junior Analyst Program is the HSF’s new member program and training that includes three meetings a week over the course of eight weeks in the fall semester. The program, led by the Head of Development, will cover topics related to the HSF including investment strategies, different asset classes, financial statements, ratio analysis, economic and technical indicators, Microsoft Excel training, professionalism, and interview preparedness. The Junior Analysts will also take part in a Valuation Education Program which consists of an in-depth analysis of the financial statements, building out a Revenue Projections Model, a Discounted Cash Flow Model, and a Public Company Comparison Model. Each Junior Analyst will become FactSet certified and trained to use the Bloomberg Terminals. Each Junior Analyst will be assigned to teams of their interest to begin contributing where best fit to succeed in the fund. The conclusion of the program will result in the presentation of a full equity pitch to the full fund where groups of three, Junior Analysts will present a potential investment to the fund that will be critiqued and showcase the culmination of their learning.

Hanley Center Director